Money is Emotional-Addressing the Human Side of Money

My weakest subject in school was always math. Some of you are nodding your heads right now saying yes, me too! Many of us see numbers and get scared, losing all confidence in our ability to be successful. The majority of the employees we have worked with over the years believe that their money stress is a math problem, but this is a MYTH. You don’t need to be a math whiz to win with money. Budgeting tools and calculators will do the heavy lifting for you.

What is needed is a greater understanding of the emotional side of money, and here at Workplace Money Coach, we approach money management with the person in mind first.

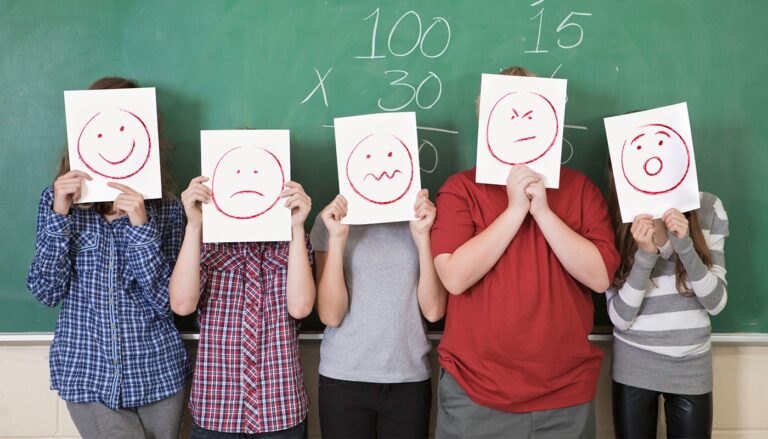

Money is personal, emotional and relational. Most of us have experienced a plethora of emotions around money:

- We might be angry that we got ourselves into a financial mess with debt.

- We might feel sadness when we consider that we are unable to do what we love to do or give generously because we live paycheck to paycheck.

- The rising costs of living may leave us feeling overwhelmed or hopeless.

- We are afraid that our lights will be turned off or our car will be repossessed.

- We might feel guilt that we can afford a nice vacation while there are some people that go to bed hungry at night.

- Envy many rise inside us when we see our neighbor’s new pool, their nice clothing and the new car in the driveway.

It is normal (and human) to feel a variety of emotions in any given day. Understanding our emotions, where they come from and our emotional response is where true empowerment and change happens. I can feel anger over something and choose not to blow up or throw in the towel. Instead, I can identify that the emotion actually is anger, question where the anger is coming from and then make an intentional choice on how I will respond.

When we work with employees through our coaching program, we walk through a step by step process to understand this emotional side of money:

- Identify the emotion: I am angry at the amount of debt I have accumulated. Every time I see how much credit card debt I have racked up, it boils my blood.

- Determine the root cause of that emotion: I am angry at myself. I overspent. The responsibility lies with me and I am angry that I put myself in a position where I am paying my hard earned money towards things from my past that weren’t even that important to me.

- Choose the response: I have choices. I can stay angry and do nothing OR I can change something. I can stop charging on that card. I can be intentional with my spending and cut back on things that are not important or essential. I can work a second job on the weekend to make extra money to get rid of this debt and keep more of my hard earned money.

All of us can move past the difficult emotions that keep us stuck on our financial journey. Going through this process allows us to face our financial issues head on and tackle them with specific actions. Change is hard, but doing the initial work to create a plan forward will give us a path to follow, no matter what detours and challenges lie ahead.

You are the hero in your story.

You get to choose your response.

You decide what life you want to live.

You are the solution.

Regina C. Novak, MPH

Financial Coach, Health Educator and Director of Workplace Programming

Workplace Money Coach has tossed aside the cookie cutter approach to telling people what to do with their money and instead embraced a coaching model that honors the whole unique person. We recognize that you are the most important piece to living the financial life you desire. If you are interested in working with us, please email financial.wellness.solutions@workplacemoneycoach.com.